How to sustainably eliminate churn

Hi, I’m Markus, and welcome to a 🔒 subscriber-only edition 🔒 of my newsletter. I help you to deliver, grow and monetize customer value to improve your performance, accelerate your career, and build a profitable SaaS business.

In last week’s edition, I showed you how to create a 360° customer view to understand

who your customers are

why they are here

where they are in the success journey

what actions did they take and why

One, if not the most important, use case of these insights is to battle (growing) customer churn.

Technically, churn is an early-stage problem that is caused by the lack of sufficient customer data.

It's a tough pill to swallow but with every new churn case, you move one step closer to solving it.

Because you start to see patterns enabling you to eliminate their root causes.

But the problem is that in most SaaS companies churn is not analyzed deep enough.

As a consequence, they keep treating the symptoms of churn over and over without making any real progress.

And the worst thing they do is to “bribe” customers to stay by giving discounts.

Erasing their margins only to find out that, in the end, customers still leave.

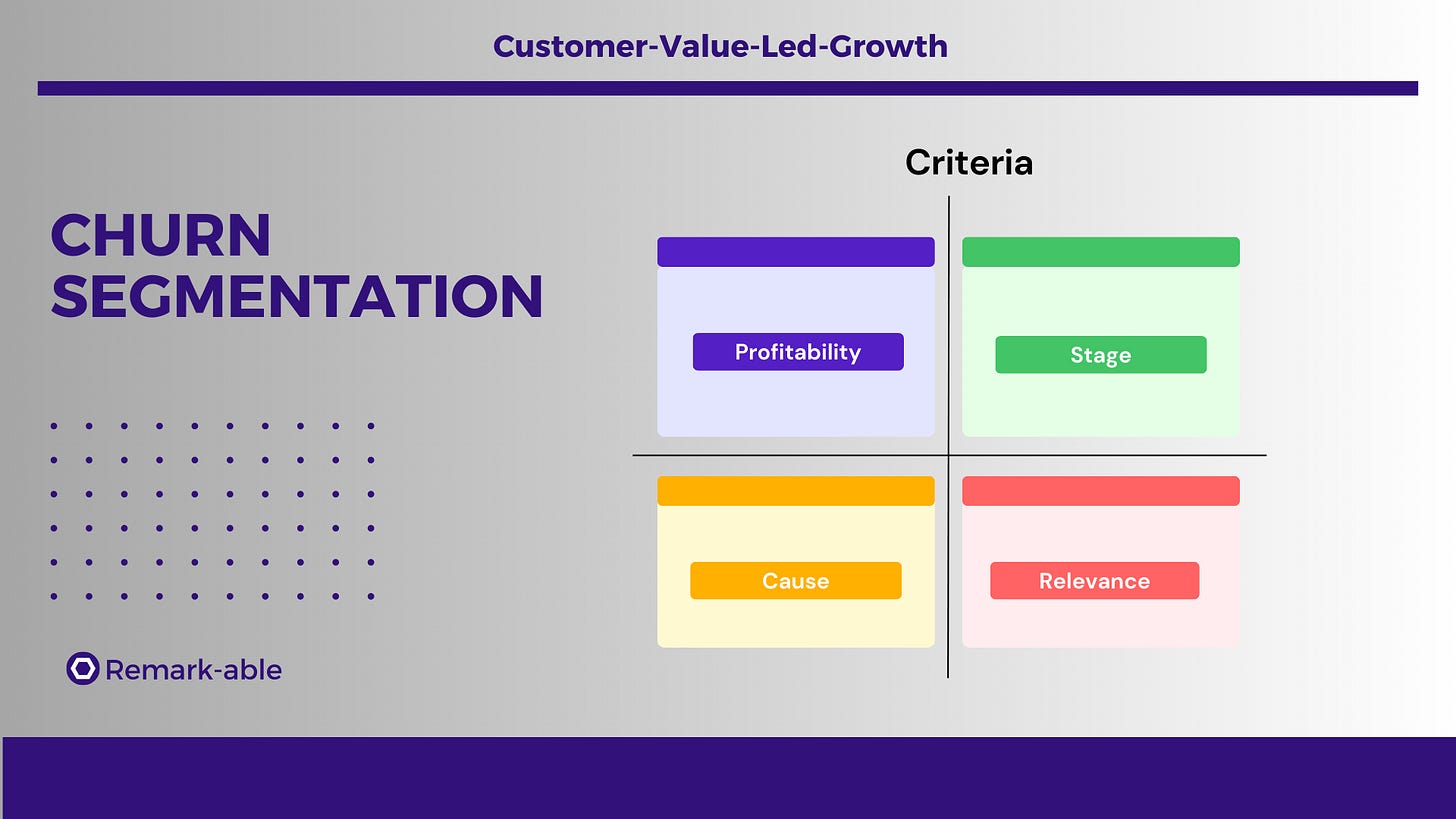

In this episode, I will show you how to eliminate churn in a sustainable way with effective segmentation:

1. Customer profitability

The first thing you need to understand about churn and retention is that they are not black and white.

There’s actually good churn and there is bad retention.

Sounds confusing?

Don’t worry I’ll get down to it in a second.

From a financial perspective, I distinguish between 4 kinds of churn:

Worst case: A customer delivering positive cash flows leaves before breaking even (before CAC is repaid). This is the worst-case scenario because they leave with a debt that would otherwise have turned into a profit.

Bad churn: The customer leaves after the break-even and you are “only” losing future revenue

Good churn: A customer that delivers negative margins month after month is leaving. That’s good churn because their renewal would have extended your losses.

Inverse churn: A customer that is not successful but stays for some reason. They require an extraordinary amount of help that creates negative margins. The longer they stay, the more money they will make you lose.

You need to eliminate all 4 kinds of churn but they require different approaches.

The “good churn” helps you to reduce your losses in the short term.

But keeping your losses under control is obviously not a long-term solution.

You need to prevent it from happening in the first place.

It’s quite a similar case with inverse churn, the only difference is that you need to actively get rid of these customers.

These 2 kinds of churn usually refer to your bad-fit customers.

But be careful, you need to be sure that the problems are caused by the customer.

If the costs pile up because you are sending customers around in circles and providing them with the wrong tools, content, and services it’s a whole different story.

Keep reading with a 7-day free trial

Subscribe to Customer-Value-Led-Growth Newsletter to keep reading this post and get 7 days of free access to the full post archives.